One of the most popular online payment platforms, Paypal, is used by millions worldwide. However, like with any other online service, scammers always look to take advantage of people. This blog will describe the top 13 PayPal scams users commonly fall for and how to keep yourself safe. By reading this blog, you’ll be able to avoid becoming a victim and keep your money safe!

13 Most Common Paypal Scams in 2023

In 2023, scammers will continue exploiting people’s trust by using various scams, such as fake invoices, unsolicited donations, phishing, and romance scams. Be aware of these scams and stay vigilant by avoiding them altogether. Remember – if it sounds too good to be true, it probably is.

1. Fake Seller Account

PayPal is a great way to easily and quickly transfer money between buyers and sellers. However, it is important to be aware of fake accounts that may try to take advantage of you. Ensure the seller you are working with is authorized to use PayPal before authorizing their account.

Always check their credit score and history before approving their account, just in case anything goes wrong. Finally, do not transfer any money until you have received an invoice or shipping notice from the seller – otherwise, you might lose your hard-earned cash!

How to verify if the seller is illegitimate

- Do a background check – verify the seller is legitimate by visiting their profile; cross-referencing their business name, location, contact, tax ID, and other identifiers.

- Look for fake business names – ensure the person has identified themselves correctly.

- Ask for an invoice or a shipping notice – so you can use it as proof of purchase.

2. Disguising as a Friend or Family Relatives

Paypal is one of the most popular online payment platforms, and for a good reason- it offers secure transactions and convenient features. However, fraudsters always look for new methods to scam people, so you should be especially vigilant when using this service.

One of the latest scams hitting PayPal users is ‘Friends and Family; fraudsters try to get you to transfer money by disguising themselves as friends or family members and asking you to send them money. Never trust unsolicited requests for payments, no matter who is making them.

Always ask for more details when you are dragged into such situations, as this will help you distinguish genuine requests from potential scams.

3. 419 or Advance Fee Scams

419 scams are some of the most common and popular online frauds; with victims in Africa, the Caribbean, and South America. These scams involve contact from people who claim to be from trusted businesses or authorities; asking for money to be sent without revealing the true purpose.

Oftentimes, these scammers may use strong-arm tactics such as pressuring you for personal or financial information before insisting that you send funds directly to a hidden account. Needless to say – don’t fall victim to this scam! There is no legitimate reason anyone would ask for your bank details upfront – it’s simply a way of scamming you out of your money!

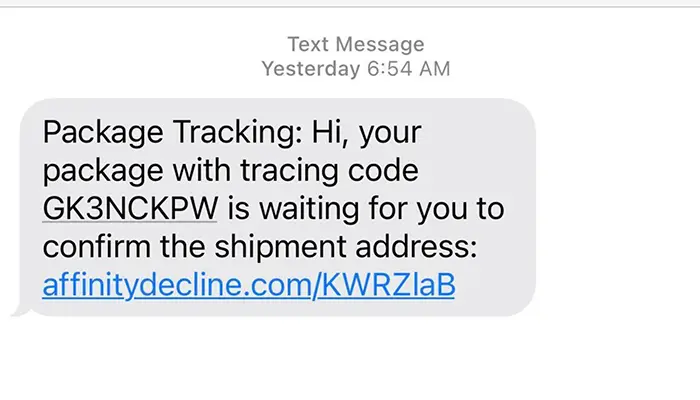

4. Shipping Address Scams

There are scammers everywhere, and shipping address scams are one of the most common. You may receive a call saying a delivery package to your name requires your address and prepaid payment via Paypal only at the delivery time to an individual’s bank account. Of course, no legitimate organization would require you to send payment to an individual’s PayPal account – this is simply a way to steal your money.

If you receive such an email or call, please do not fall for it! Instead, contact the company or individual who sent you the package directly to ask about the delivery and ensure that everything is okay. If it isn’t – please let them know and don’t send any more payments until you have confirmation from the sender that everything is as it should be.

Scammers will get you to send them money by asking for your shipping address; Don’t fall for it – always double-check the legitimacy of the person or website you are dealing with.

5 Tips to Detect a Fake Shipping Scam

- Typically, shipping scams involve high-pressure tactics to get you to send money directly to an individual’s bank account.

- The scammer may request for your shipping address or payment information before confirming the delivery.

- If you don’t receive an expected package; and if the seller doesn’t have a good track record, be skeptical and don’t send any money.

- Be aware of companies that offer free shipping in exchange for payment via Paypal – this is a common scam tactic.

- If you have any questions or concerns, contact the company directly. Don’t trust unsolicited emails and phone calls asking for your shipping address or payment information.

5. Overpayment Scams

When it comes to scamming, scammers always devise new and clever ways to dupe people. That’s why it is important to be aware of the various scams, especially those involving overpayment. In this Paypal scam, scammers will call you disguised as Paypal customer service; saying they have accidentally transferred some extra amount to your account and need you to help them cancel the transfer or pay it back.

Of course, this is a scam – there is no such thing as an accidental overpayment on PayPal! If you receive such a call, do not oblige the scammers and hang up. Instead, contact Paypal directly and ask them about the situation. You can also file a complaint with their authorities to protect yourself from future scams involving overpayments.

Also, beware of requests for personal or banking information, as these could be scammers trying to steal your money. If you fall victim to a scammer; don’t hesitate to reach PayPal immediately! They will help you ensure that your money is returned safely and quickly.

5 Tips to be Safe from Overpayment Scams

- Be cautious of unsolicited phone or email requests for your personal financial information.

- Never accept transfers of more than the selling price.

- If someone asks you to pay back an overpayment; be suspicious and contact PayPal immediately.

- Never transfer money to someone you don’t know or trust.

- Don’t act under the pressure of urgency -scammers trick victims by pressuring them.

6. Fake Invoice Scams

Fake invoice scams are on the rise, and they can be very costly; this scam is generally targeted at individuals, business owners, and small businesses that are particularly vulnerable.

In this scam, a scammer will send an invoice for services that never existed or were not performed and say that the payment is to be made by Paypal only; otherwise, you may get fined. The goal is to steal money from the target by claiming they have to pay back these nonexistent bills.

To avoid being scammed, always be aware of any unsolicited invoices you get in your mailbox – and beware of requests for personal or banking information, as these could be signs that you’re dealing with a scammer. If something feels off about an invoice, don’t hesitate to contact the company directly and ask them about it – they should be.

They may even use falsified documents to make the invoice seem legitimate. To prevent this from happening; double-check the authenticity of any invoices you receive and never pay without getting a written receipt from your vendor.

How To Detect A Fake Invoice :

- Be wary of substantially higher invoices than expected for the services or products involved.

- Check if your vendor has online reviews or testimonials from previous customers; this will help you verify the authenticity of the invoice and potentially protect yourself from a scam.

- Ask your vendor about their return policy – fake vendors may not have one!

- If you’re unsure about an invoice, contact the company directly to get more information. If you fall victim to a fake invoice scam; contact your bank and PayPal immediately to report the fraud.

7. Fake Charities, Causes, and Fundraising

Fake charities are currently one of the most popular scams on PayPal; they’re only going to become more prevalent in the coming years. These scams involve individuals stealing your money by posing as legitimate charities and misleading you into thinking that your donation will go a long way.

In this scam, Scammers approach you posing as a charity organization, and ask the payment to be done by Paypal only. You might think your donation is going to a charity fund; however, in most cases, this money is stolen and never reaches the intended charity.

Use services like Charity Navigator and Charity Watch to verify whether the charity you’re donating to is legitimate. Apart from that, you can also view ratings given to charities by give.org to draw better conclusions about your donations.

Also, ensure to check if the charity you’re donating to is registered to raise funds in your state from IRS.gov

4 Tips to Avoid Becoming a Victim of a Fake Charity Scam:

- Be very suspicious of requests for donations; especially if the donation is asked to be made from a specific payment gateway only.

- Don’t give away your personal information until you’re sure the organization you’re donating to is legitimate

- Check out the website and contact details of any charities you are considering donating to – make sure they’re up-to-date and properly registered with Charity Navigator.

- Don’t act to time-bounded charity donations without verifying their online presence.

If people don’t report these activities to PayPal, it can lead to significant injustice and loss of money. Be especially careful of fundraising scams – these fraudsters might ask for donations unexpectedly or make unrealistic claims about how much money has been raised. Always be vigilant when it comes to online financial transactions!

8. Account Suspended Scam

Suspended account fraud is on the rise, and it’s easy for scammers to take advantage of unsuspecting people. If you receive an email from PayPal stating that your account has been suspended – don’t trust it!

You may receive an email or phone call from someone telling you that your Paypal account has been suspended, and to reactivate that account, you have a pay an account reactivation fee to the scammer‘s PayPal account.

If you receive this type of email, don’t fall for it! PayPal will never contact you about your account suspension – and if you do pay the reactivation fee, your money will likely go to the scammer’s pocket. Be very careful when opening suspicious emails or clicking on links in them.

Whenever you receive such e-mails, check the address of the mail resembles @paypal.com.You can also use IPQualityScore and Xverify to verify mail addresses; these services contain large databases of fake emails used by scammers and reported by users.

Lastly, never give out personal information – like your credit card numbers or social security number – to anyone you don’t know. If something sounds too good to be true, chances are it is! So before doing anything else, check with a trusted friend or family member first. And if all else fails, contact PayPal directly for verification purposes.

9. Transfer Waiting scam

The “you have money waiting” scam is a well-known fraud where scammers pretending to be PayPal employees try to obtain personal information from their victims. They will often start by emailing the victim, claiming that there has been a mistake with the victim’s PayPal account and account balance is waiting to be withdrawn – usually in the form of an electronic transfer.

Once you click on the received mail link, you’re redirected to a phishing site that may look exactly similar to a legitimate Paypal site; however, once you enter your login credentials, scammers get hold of your account data.

If you receive an email about a “transfer waiting” issue, don’t trust it! There is no such thing as a pending transfer – any money that may be waiting for you will have already been transferred by the time you receive this email. Don’t enter your login credentials into the scammer’s site either; just delete the message and avoid being scammed in the future.

Tips for detecting a phishing email

- Be suspicious of emails that ask for your personal information, such as login credentials or credit card numbers.

- Check if the redirected site uses HTTP or HTTPS; sites using HTTP are generally dangerous and should be avoided.

- Check the sender’s email address and see if it matches any legitimate PayPal accounts, e.g., [email protected].

- Look for suspicious keywords or phrases in the email message, such as “transfer waiting” or “password reset instructions.”

- Try finding patterns of unprofessional wordings, grammatical errors, or unprofessional looks of the mail.

- Check if the e-mail received is automatically showing in the spam section of your mail application.

Check out our Phishing guide in 2023

Asking for passwords or bank details is a giveaway that this isn’t a PayPal issue but rather something more sinister. If someone you don’t know asks for your personal information like this, be very suspicious and contact PayPal immediately!

10. Your Account is Hacked Scam

The “hacked account” Paypal scam is becoming increasingly common, as fraudsters use email phishing techniques to trick people into revealing their personal information; This scam starts with a fraudster convincing you that your PayPal account has been hacked.

They then ask for your bank account or credit card details to fix the problem. Always be suspicious if someone asks for your personal information online – it could be a scammer! Paypal will never ask for your login credentials or for your bank account details. If you think your PayPal account has been hacked; don’t hesitate to contact the Paypal customer service team.

If you’re unsure if your PayPal account has been hacked, the best way to check is to sign in and look for any suspicious activity. If there’s been any unusual activity on your account; like unauthorized transfers or messages from scammers requesting personal information, it’s most likely that your account has been hacked.

If you find evidence of a hack, don’t panic; immediately change your account password and contact the Paypal customer service team as soon as possible to report the issue and get help recovering your funds.

Don’t fall for schemes where you must pay money to get your account back – this is a common PayPal scam in 2023. And finally, avoid clicking on links or downloading attachments from people you don’t know – they could be part of a scam campaign!

11. Alternate Payment Method scam

This is a common fraud where scammers try to trick you into thinking they are sending you money using a different payment method; This could be anything from a strange email to a phone call asking for your bank details.

For example, If you ordered a product and set the payment method as Cash on Delivery. Somehow scammers will know about your order and may trick call you, saying that Cash on Delivery will not be accepted; you need to pay via Paypal only; otherwise, your order will be canceled.

Most victims fall for such scams by making payments to scammers thinking they’ve paid for their delivery while they’ve just handed over their money to the fraudsters.

Don’t let fraudsters pressure you into making quick decisions – always research the option first!

12. PayPal “Family and Friends” scam

Paypal has fail-safe implementations whenever someone executes transactions with Paying for an item or service option for buying or selling goods; however, Paypal charges extra fees for this service.

For Example:

- If you are selling products on eBay and want to accept PayPal as your payment method; there is a fee of $0.50 for each sale via PayPal.

- If you buy goods from someone who sells on eBay; there is an additional fee of 2.9% of the total purchase price (minus any fees eBay charges).

Due to this, even if you transfer money to scammers, it can be reverted to your account once you file a Paypal report with proof providing you’re scammed.

However, the Family & Friends transfer option does not offer this security as you send money directly to a relative or friend. And this is what is leveraged by scammers, and some scammers may trick you into transferring money via the Family and Friends option. If a seller tells you to transfer money via the Family and Friends option for buying products, it’s most likely a scam.

Once you transfer money via the Family and Friends option, there’s a high probability that you may never get your hard-earned money back. So ensure to follow the rule prevention is better than cure.

13. Paypal Employment Scam

This is a very sophisticated Paypal scam where scammers trick employees into selling their products; The victim is contacted by an individual claiming to be from their company or a client. They offer the victim an opportunity to sell a product and ask for payment in advance.

Once the money has been transferred, the scammers disappear with the victim’s money without providing anything in return. This is another Paypal scam that can take many forms, such as:

- Requiring you to buy products before selling them on behalf of your employer; could be anything from office supplies to software downloads etc.

- Offering high commissions

- Requesting Detailed Personal Information

Once you are contacted by someone claiming to be from your company or a client, it’s important not to give them any personal information immediately.

Don’t pay them in advance until you have been allowed to examine the product and decide whether to sell it on behalf of your employer.

If anything seems suspicious or you don’t feel confident about the offer, please report it as fraud immediately.

Paypal Buyer Protection

Paypal offers Buyers Protection to protect users from all sorts of scams. You are eligible for it if you match the requirements below.

Eligibility Criteria

- Made a purchase using a PayPal account in the European Economic Area (EEA).

- Paid for items with a single transaction.

- The Dispute is filed within 180 days of the transaction.

- The merchant sold the product(s) involved in the dispute following Paypal shipping policies.

Paypal Seller Protection

Paypal also offers seller protection to ensure that all sellers do not get scammed in one way or another.

Eligibility

If you meet the eligibility criteria below, you are covered by Paypal Seller Protection.

- The Unauthorized Transaction occurs in an environment hosted by Paypal.

- The seller’s PayPal account address is in the United States.

- Items sold must be physical only.

- Have valid Proof of Delivery documents.

How to Report Fraud & Unauthorized Activity To Paypal

To report a scam to PayPal, please follow these steps:

- Sign in to your PayPal account and go to the Report Fraud & Unauthorized Activity page.

- Under Scams and Ripoffs, select the type of scam you believe occurred and choose whether or not you’ve been scammed yourself.

- If you have been scammed, provide as many details as possible about the incident, including how money was transferred, what goods were allegedly purchased, etc.

- If you provide information on behalf of someone else who believes they may have been scammed, include their name and email address.

- Click the Report link next to the scam you’ve selected.

- You will be taken to a page where you can provide more information or upload documents related to your case. Please note that some scams may require additional verification before being processed by PayPal.

- Once your report is completed, PayPal will take action as appropriate to investigate and prevent future scams from occurring.

4 Tips to Avoid Getting Scammed Online:

- Beware of emails that ask for your bank account or credit card details – these are scams!

- Always use common sense when dealing with online transactions – never send money without verifying the sender first!

- Check the email address against those of companies you do business with – if it isn’t legitimate, don’t follow through with anything!

- Don’t pay any money until you have verified the request is from a company you trust and knows what they’re doing.

Conclusion

This blog has outlined 13 PayPal scams you should be aware of in 2023; by reading this blog, you will be well-prepared to avoid these scams and protect your valuable information. Keep an eye out for email notifications about scam alerts; always exercise caution when using PayPal! If you have fallen victim to a scam; don’t hesitate to contact us for help. We would be more than happy to assist you in any way possible.